During the past few years, the Swedish tax agency have focused on increasing the incentive for any organisation that invests in Research and Development (R&D) work in Sweden. Milena Boyanova, Senior Manager in the Expatriate Payroll department at Aspia, tells you all about Research and Development incentive for foreign and Swedish companies.

A short history

As of 2014, employers have been allowed to deduct employer social security contributions for employees who work on systematic and qualified research and/or development.

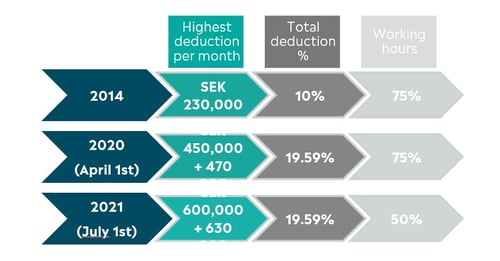

The opportunities for companies who carry out R&D, have improved gradually since 2014 and the rules for employer contributions' reduction for R&D professionals, have been consistently enhanced as follows:

What difference can this make?

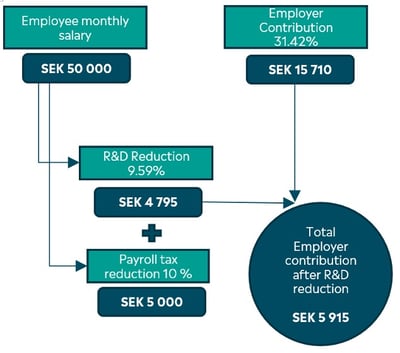

If you are a Swedish or foreign company that pays employer contributions in Sweden, you are aware that the social security system in Sweden is mainly financed through employers' contributions, where 31.42% (for 2022) of the total remuneration paid to the employee is charged to the employer in social security fees.

The R&D reduction of these employers’ contributions can be applied for both employees and contractors and there are no formal restrictions, which industries can be covered, as long as the Swedish tax agency requirements are met. Since April 2020 the R&D reduction is 19.59%.

Research deductions may only be made for a person who works for at least 50% and at least 15 hours of their actual working time with research or development during a month. If the person working with R&D has a part-time job, e.g., 32 hours per week requires the person to work at least 16 hours (50%) per week on average with research or development in order for the employer to be allowed to make deductions.

How do I use the deduction?

If you have or have had individuals who may have been covered by the rules in the past 6 years, there is an opportunity to request a reassessment of the company’s employer declarations in order to receive the deduction now.

Or, if you are simply curious to learn more and have an open discussion with me, you are welcome to contact me.

Only for 2021 your company can request a reassessment and receive a reduction to a maximum of 12.8 million SEK (approx.).

If you have any questions or need help to figure out if you can receive the support, don’t hesitate to get in touch with our experts at Aspia!